Converse is falling behind financially – and we are in trouble.

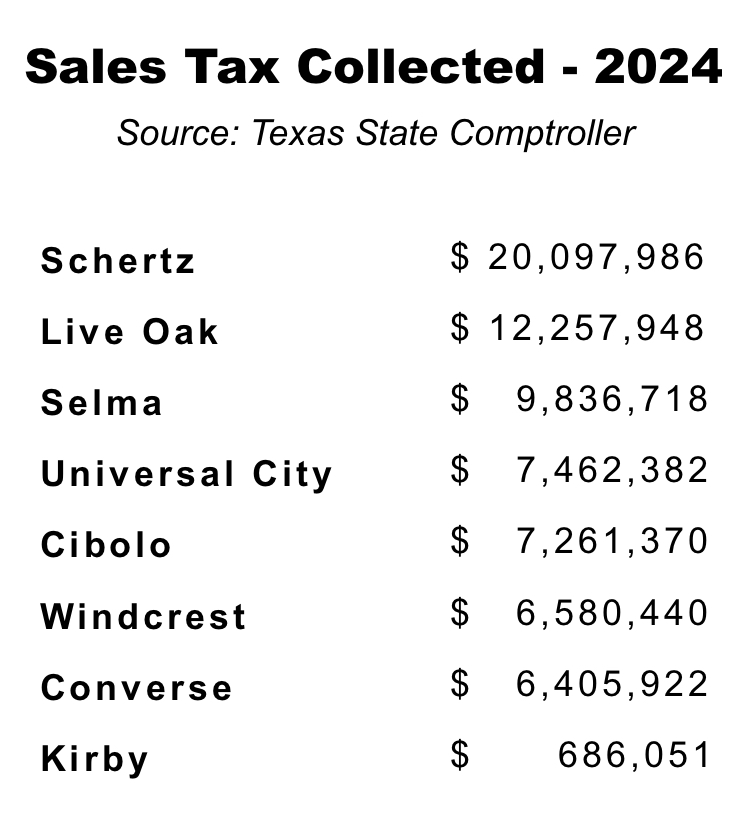

We are surrounded by cities that can afford to improve their streets and provide quality services. The chart below shows just how far behind we are on Sales Tax collected:

As a result, Converse is suffering:

- City employees are under-paid compared to their Metrocom peers

- Our streets are in disrepair and their maintenance is reactive instead of scheduled

- Sidewalks are falling apart or are non-existent

- Our streets are dark and we need more streetlights

- Police officers are over-worked

- Our Property Crime Rate is too high

Our residents leave town for work, shopping, and entertainment – and so does our sales tax.

Our City budget relies far too much on property taxes, and we are second to last in sales taxes. We are the second largest city in Bexar County – and yet, few people know Converse has the highest poverty rate in the Randolph Metrocom area. (13.8% – Source: US Census)

Right now, we use a combination of our General Fund, Certificates of Obligation, and a 1/4 cent sales tax for road maintenance. Each of those has a consequence.

- The General Fund pays for city operations and is not limited to road maintenance. It’s largely based on Property Taxes (Ad Valorem). The only way to bring in more money is to raise the effective Tax Rate on residential and commercial property. That means we have to pay more taxes.

- Certificates of Obligation (CO) allow the city to borrow money now and pay it back over several years. This doesn’t require a public vote or your approval. The repayment schedule and interest rate are also based on how much the city can generate in Property Taxes. The only way to issue more COs, is to pay back the existing ones and/or increase the Tax Rate.

- The 1/4 cent sales tax dedicated for road maintenance sounds good, but its really taking that money from the Converse Economic Development Corporation (CEDC). It came from a 1/2 cent sales tax dedicated to fund the CEDC and their efforts and bring in new employers. City Leaders asked voters to cut the CEDC funding in half and didn’t explain the consequences. Namely, a severely limited ability to recruit new employers and keep our existing ones. Without more business, your tax rate will go up.

Our Budget is Built on Property Taxes

Why is this important? Because our collective ability to maintain this community and build for the future rests on Property Taxes. Since our current elected leaders keep the tax rate low, it also means we have limited resources every year. But even they know that’s not sustainable and have begun raising your taxes. I want to change that by increasing our ability to generate revenue through Sales Taxes.

We Need More Local Jobs

To maintain our infrastructure and improve our quality of life, we must encourage businesses to grow here. Without economic development, your taxes will go up. I will launch a Converse Economic Opportunity Zone Program to focus development along commercial corridors. This will bring in new companies, increase local jobs, and support our existing businesses.

We can bring home more sales tax revenue to:

- Maintain our existing and aging infrastructure with more regular and scheduled maintenance

- Improve our quality of life with increased public amenities in our public parks and recreation areas

- Beautify Converse and create a true town center to build community

- Provide quality compensation to our hardworking employees who have historically left Converse and joined other cities